Capital Off the Cuff

Things you actually want to read. That's all we plan to put out here. Educational, informational, slightly silly... but always completely honest content that's relevant. New posts will be showing up regularly, so don't forget to check back!

Why Choose a Credit Union Mortgage over a Traditional Bank Loan?

Discover why a credit union mortgage may beat a traditional bank loan, with lower rates, flexible terms, and personalized service designed for members. ...

Read This Article about Why Choose a Credit Union Mortgage over a Traditional Bank Loan?

Top Tips for Staying Secure When Using Digital Banking

Manage money securely when using digital banking. Learn smart tips for passwords, two-factor authentication, and safe account monitoring to protect your finances. ...

Read This Article about Top Tips for Staying Secure When Using Digital BankingExplore Off the Cuff

How Do Share Certificates Work?

Learn how share certificates work, how they differ from CDs, and why they’re a smart, secure way to grow your savings with guaranteed returns and low risk. ...

How To Use a Home Equity Loan to Renovate Your Home

Learn how to use a home equity loan to renovate your home and boost its value. Refresh your space with a loan that fits your financial goals. ...

Everything a Capital Credit Union Business Account Has to Offer

Discover all a Capital Credit Union business account offers—easy deposits, higher dividends, loans, credit cards, and tools to help your Wisconsin business grow. ...

What Causes Wisconsin Mortgage Rates to Fluctuate?

Wondering why Wisconsin mortgage rates change? Learn how the Fed, inflation, market shifts, and local trends impact rates and how to get the best deal. ...

How To Maximize Benefits of Rewards Checking Accounts

Maximize rewards checking benefits with smart strategies. Meet monthly requirements, manage balances, avoid fees, and take full advantage of account perks. ...

Best Tips for Getting Competitive Credit Union Home Loans

Buying a home is an exciting investment in your future. Securing a home loan is an important step in making your dreams of home ownership an attainable reality. The terms of your home loan will determine your monthly payments as well as how much your home will cost you in...

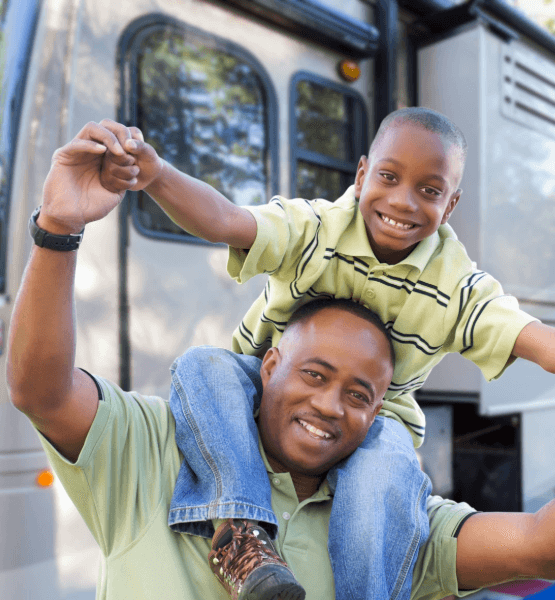

Recreational Vehicle Loans Made Easy: Benefits of a Credit Union Loan

Discover how a credit union recreational vehicle loans can help you buy a boat, RV, or ATV with benefits like low interest rates, flexible terms, and more. ...

Explore the CCU Checking Account Options

Discover each CCU checking account option, designed to provide you with a variety of benefits based on your goals and what you want your money to do for you. ...

A Step-by-Step Guide for Opening a Share Certificate

Are you looking for a safe way to save money and earn a predictable return? If you don’t need access to the money immediately, you might consider opening a share certificate with your credit union. With a share certificate, you deposit a certain amount of money for a set period...

5 Ways to Improve Your Financial Literacy

Boost your financial skills with free financial literacy classes, smart budgeting, credit tips, and more. Take control of your money and build a secure future. ...

How Can I Use My Credit Union Business Loan?

Discover five ways to use your credit union business loan, from purchasing equipment to managing cash flow, expanding operations, and improving marketing efforts. ...

Is a Health Savings Account at a Credit Union a Good Option for You?

Explore the benefits of a health savings account from a credit union for tax savings, investment options, and secure planning for medical emergencies. ...

5 Reasons to Open a ChaChing™ Checking Account this Year

If you’re looking for the easy access of a checking account with the earnings of a high-interest savings account, look no further than Capital Credit Union’s ChaChing™ checking account. Our high-yield checking account is designed to help your money grow with our highest dividend rate possible while offering the freedom...

Strategies for Managing Debt and Regaining Financial Independence

Create an effective debt repayment plan with strategies such as debt consolidation or the debt snowball and avalanche methods for repaying what you owe. ...

Important Birthdays Over 50

Here's a look at several birthdays and “half-birthdays” that have implications regarding your retirement income. ...

How a Teen Checking Account Teaches Financial Literacy

A teen checking account fosters essential financial literacy skills, helping teenagers learn to budget, save, and make informed financial decisions for the future. ...

Is Using Home Equity for Home Renovations a Smart Financial Move?

Is using home equity for home renovations a good move? Explore the pros, cons, and key considerations to make informed decisions for your financial future. ...

Which Capital Credit Union Credit Card Is Right for You?

Discover the benefits of each Capital Credit Union credit card and find the perfect fit for your lifestyle with rewards, travel points, cash back, and more. ...

Tips for Securing the Best Car Loan Rates in Wisconsin

Find the best car loan rates in Wisconsin! Learn how to improve your credit, get pre-approved, and compare offers to secure the ideal auto loan. ...

AI Tools Changing Retiree Entrepreneurship

By harnessing the power of AI, retirees can enhance their productivity, save time, and make their business endeavors more successful. ...

.jpg)

Emotional vs. Strategic Decisions

Information vs. instinct. Are your choices based on evidence of emotion? ...

What Is the Greenlight Card for Kids?

The Greenlight card for kids teaches budgeting, saving, and smart spending with parental controls, offering a safe way for kids to learn financial responsibility. ...

How the Federal Reserve Works

Have you ever taken a close look at paper money? Each U.S. bill has the words "Federal Reserve Note" imprinted across the top. ...

Social Security: The Elephant in the Room

As the growing wave of citizens approach retirement, questions and concerns abound. Is Social Security financially healthy? How much will my income benefit be? ...

New Retirement Contribution Limits for 2025

The Internal Revenue Service (IRS) has released new limits for certain retirement accounts for the coming year. ...

Traditional vs. High-Yield Checking Account: Which Is Right for You?

Compare the features, pros, and cons of traditional vs. high-yield checking accounts to determine which suits your financial needs and goals best. ...

What Are the Benefits of a Credit Union Car Loan?

Discover the benefits of a credit union car loan, including lower interest rates, flexible terms, easier approval, first-time buyer programs, and personalized service. ...

How To Tap Into Your Home Equity: Options and Strategies

Unlock your home equity with options like credit union home equity loans, HELOCs, and cash-out refinancing. Discover strategies to meet your financial goals. ...

How To Make the Most of Your Local Credit Union Auto Loan

Discover how to maximize your local credit union auto loan with tips on pre-approval, securing low rates, and leveraging member benefits for your next vehicle purchase. ...

How Debit Cards for Kids Can Help Build Money Management Skills

Learn how a debit card for kids can teach budgeting, saving, and responsible spending habits, helping them develop essential money management skills early on. ...

Eight Mistakes That Can Upend Your Retirement

Pursuing your retirement dreams is challenging enough without making some common, and very avoidable, mistakes. Here are eight big mistakes to steer clear of, if possible. ...

When Is the Cost to Refinance a Mortgage Worth It?

Discover when the cost to refinance a mortgage is worth it. Learn about lower rates, break-even points, shorter loan terms, and switching to fixed-rate mortgages. ...

5 Ways to Use Your Home Equity Loan This Year

Your home is one of the biggest assets you have, especially if you’ve paid off a large portion of your mortgage. With so much equity sitting there, why not consider using a home equity loan for remodeling your home or investing in your other financial goals? ...

Follow These Strategies to Get the Best Deal on a New Car

Discover how to secure the best deal on a new car with strategies like market research, pre-approved financing, and getting the best loan rates in Wisconsin. ...

Saving Early & Letting Time Work For You

As a young investor, you have a powerful ally on your side: time. When you start investing in your twenties or thirties for retirement, you can put it to work for you. ...

Retirement Seen Through Your Eyes

How do you picture your future? Some see retirement as a time to start a new career. Others see it as a time to travel. Still others plan to spend more time with family and friends. With that in mind, here are some things to consider. ...

Catch-Up Contributions

A recent survey found that 18% of workers are very confident about having enough money to live comfortably through their retirement years. At the same time, 36% are not confident.1 ...

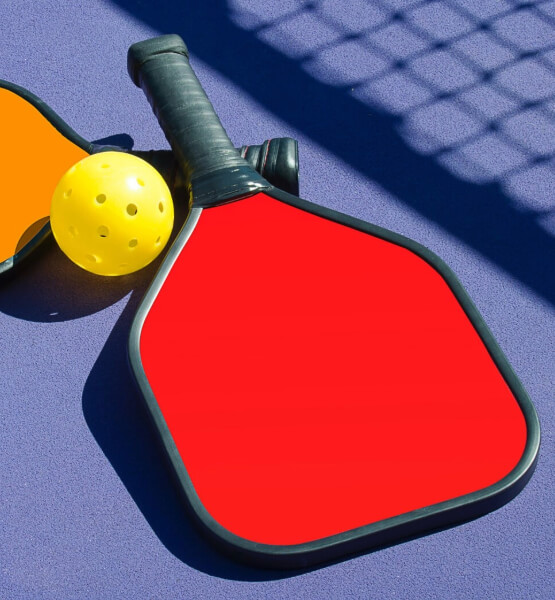

Pickleball in Retirement

Staying Active in RetirementOver the last couple of years doctors have made clear the benefits of regular physical activity, especially for older adults. In fact, adults 65 and older gain substantial health benefits from regular physical activity. Being physically active can increase mobility, lessen the chance of injury, and lead...

Harness Your Home’s Value: Home Equity Loans Explained

Unlock the potential of your home equity with this comprehensive guide on home equity loans, tailored to help you make informed financial decisions. ...

5 Reasons to Choose a Wisconsin Credit Union for Your Banking Needs

Discover why choosing a Wisconsin credit union can offer community-focused, low-cost banking solutions that benefit both members and their communities. ...

2024 Guide to Cyber Security in Banking: Protecting Your Financial Data

Learn about cyber threats and scams that can endanger your finances and explore essential strategies for cyber security in banking to protect your financial data. ...

Starting A Roth IRA For A Teen

This early financial decision could prove helpful over time. Want to give your child or grandchild a financial head start? A Roth IRA might be a choice to consider. Read on to learn more about how doing this may benefit both of you. ...

What's So Great About A Rollover?

Making a career move requires tough decisions, not the least of which is what to do with the funds in your retirement plan. ...

Are There High-Interest Checking Accounts?

Making money from your checking account is an idea that most people can get behind. We could all use a little extra money in the bank, and while standard checking accounts can sometimes offer you a small percentage of interest back on your balance, there may be other options available...

5 Tips for Saving for a Large Expense

If you want to save money for a big expenditure, don’t let it intimidate you. Often, when people sit down and calculate exactly how much they need to save, they end up shying away from the plan since it seems out of reach. But we’re here to share with the...

How Can I Use a Capital CU Personal Loan?

Personal loans are a great way to achieve financial goals faster. Rather than slowly building up enough savings before pursuing your goals, be proactive with Capital CU personal loans. Apply for a personal loan to cover unexpected emergencies without stressing over where the money will come from or begin living...

Financial Wellness Starts Here: Explore Our Savings Options

At Capital Credit Union, we want our members to have the best possible financial future. We know how hard northeast Wisconsin residents work for their money. That’s why we offer a number of options, from traditional savings accounts to share certificates to HSAs, to help you save the most and...

How To Get the Best Auto Loan Rates in Wisconsin

Discover how to secure the best auto loan rates in Wisconsin. Save on your vehicle purchase and start driving with confidence when you partner with a credit union. ...

Master Your Money: Tips for Living on a Budget

Determined to master your money in the new year? Smart idea! Staying on top of your finances begins with living within your means, which means you’ll need to create a budget and stick to it. Luckily for you, Capital Credit Union is here to help. We’ll show you how to...

What You Can Do to Better Protect Yourself from Fraud

Scams are on the rise this tax season. If you’re reading this, chances are you’ve received some sort of fraudulent communication recently. Whether it was an “iffy” text message, a phone call you weren’t expecting, or a questionable email – scams are more prevalent than ever. ...

What Is the Capital CU Auto Loan Auto Deductible Reimbursement Option?

Want to get moving on your vehicle purchase and ensure you’re protected in case the unexpected happens? Capital Credit Union is your answer. Not only do Capital CU auto loans have great rates, but they also come with the option for auto deductible reimbursement. Read on to learn what auto...

Earning More With Less Risk: The Benefits of Certificates

Having a savings plan is important for reaching your financial goals. What are you saving for? How can you maximize your savings to reach these goals sooner? You’ve worked hard for your money; now it’s time your money works hard for you. ...

What Is Private Mortgage Insurance?

What is private mortgage insurance? It is insurance that protects lenders when borrowers pay less than 20 percent down on a home. ...

Comparing Interest Rates and Terms: How to Secure the Best Home Loan Deal

Are you getting ready to buy a home? A mortgage is a major financial decision, but when you have the right tools, you can feel confident about the choices you make. So, before you start home loan shopping, figure out your priorities and do your research, and you’ll set yourself...

How To Open a Checking Account Online

Discover the simple steps for opening a checking account online, and explore expert tips so you can find the best checking account for you. Get started today! ...

How To Find the Best Home Equity Loan Rates in Wisconsin

Discover how to find the best home equity loan rates in Wisconsin with our comprehensive guide. Compare rates, assess your financial situation, and secure a great deal. ...

Avoid Common Mistakes: How To Compare Wisconsin Auto Loan Offers

There is a lot to consider when comparing Wisconsin auto loan rates and offers. Explore the dos and don’ts so you can find the best deal for your new vehicle. ...

Earn More With a High-Interest Checking Account – Start Now!

You can save more with a high-interest checking account and reach your financial goals sooner. You work hard for your money, and a checking account is a great way to keep that money in reserve for easy access and day-to-day spending. However, what if your checking account could also earn...

Refinancing Your Way to Savings: Maximizing Benefits of Home Loan Refinance

Saving money is the best way to set yourself up for financial success. If you own a home, you may be wondering how to maximize the benefits of a home loan refinance. Lucky for you, helping our members save money is one of our favorite things to do. Capital Credit...

Emergency Funds 101: Why You Need a Savings Account

Maybe your car won’t start. Or the electricity goes out, requiring you to replace all the food in your refrigerator. Emergency funds can help with that. But first, you’ll have to build up those funds. It’s simple: just set up a traditional savings account and add to the balance regularly....

Maximize Savings With Certificates: Your Complete Guide

You have many options when it comes to home loan refinances. Discover what you need to know when it comes to leveraging the benefits of refinancing your home loan. ...

Your Path to Homeownership: A Guide to Different Home Loan Options

There’s more than one way for you to reach your goal of homeownership. Explore the different home loan options available to you in northeast Wisconsin. ...

Where Is the Best Place to Get a Car Loan?

Consider the different types of car loans, the pros and cons of each, and ultimately, which options might be the best place to get a car loan for you. ...

Checking vs. Savings Accounts: Understanding the Differences and Benefits

When setting up your finances with a credit union, you will need to consider which account type will best suit your needs. The two most common types of accounts are checking accounts and savings accounts. While both accounts are ways to store your money, each has its own benefits and...

The Ultimate Guide to Holiday Budgeting and Online Shopping Security

'Tis the season of joy, celebration, and generosity! As we start embracing the holiday spirit, surrounded by festive ads and tempting deals, it's important to find balance between enjoying the festivities and being mindful of our finances. After all, no one wants to start the new year with unnecessary financial...

How To Use a Home Equity Loan to Buy a Second Home

If you’re in the market to buy a second home, you may be wondering how to finance the down payment if you’re not selling your current home. You may have built up equity in your existing home, for instance, but your cash reserves are a little low. If this sounds...

When Is a Good Time to Refinance Your Mortgage?

Unlock the benefits of mortgage refinance loans with expert advice on when to refinance your mortgage. Learn about the ideal timing and opportunities to save money. ...

How to Protect Yourself From Skimmers

Though easy and convenient, ATMs have become a common place for criminals to steal your information through skimming devices, which can turn one simple errand into a nightmare. Despite how deceiving they may be, there are still ways to catch a skimmer. ...

5 Insider Tips for First-Time Car Buyers

It’s exciting to buy your first car and finally have the independence to travel where you want to go and not depend on public transportation. Buying a new car is a big investment, so you want to do it right. That means more than just finding the right car; you...

How To Qualify for a First-Time Home Buyer Loan in Wisconsin

Few people have the cash on hand to purchase their first house outright. That’s why you have the option of qualifying for a first-time home buyer loan in Wisconsin. Learn more. ...

Credit Union Money Market Account vs. Regular Savings Account

Saving your money is one of the best ways to feel financially empowered. If you have an emergency pop up unexpectedly, you can breathe easier knowing you have money saved to cover the cost. But when it comes to saving your money, does a credit union money market account or...

How Do I Open a Checking Account at a Credit Union?

Most people choose to store their money in a financial institution, rather than keeping it all at home. It’s both safer and more productive. You have some options when choosing a financial institution where you can open a savings or checking account, but many people choose to bank with a...

Are you Ready to Buy a Home?

There are a few key factors to consider when deciding if it’s time to buy a home. Discover if you are ready to make the purchase with a northeast Wisconsin home loan. ...

5 Home Improvements to Make With a Home Equity Loan

Making improvements to a home is something many homeowners dream of doing and finding the money to do so is easier than you think. Large expenses like home improvements are made a reality for people when they choose to tap into their home equity. Home equity loans often come with...

How Much Money Should I Keep in My Checking Account?

Have you ever wondered how much money you should keep in your checking account? We can help you figure that out. The team at Capital Credit Union helps members open and manage their checking accounts in Wisconsin every day. We’ll share some tips for knowing how much money to keep...

Should I Auto Finance With a Credit Union or Dealership?

Discover a world of options with Capital CU auto finance. Get low rates, convenience, and protection whether you choose credit union or dealership financing. ...

Credit Unions Have the Best Home Loan Rates in Northeast Wisconsin

A home is likely to be one of the most exciting purchases you’ll ever make. It’s also likely to be one of your largest investments. So why not try to save as much money as possible on your home loan purchase? ...

Is It Better to Get an Auto Loan With a Private Lender?

Discover whether a private lender is right for your next auto loan or if there is a better option, such as a Capital auto loan from Capital Credit Union. ...

5 Benefits of a Credit Union Auto Loan

A credit union auto loan is often the most cost-effective loan choice, as credit unions offer lower interest rates and fees and added benefits for members. ...

5 Tips for Finding the Best HELOC Rates in Wisconsin

HELOCs allow homeowners to access the equity they’ve built up in their homes. Check out our expert tips for securing the best HELOC rates in Wisconsin. ...

How to Create a Monthly Budget

To have a handle on your cash flow, you need to know how much money you have coming in and going out. Learn more about budgeting from your local Wisconsin credit union. ...

5 Reasons to Open an Account With a Credit Union in Northeast Wisconsin

Credit unions offer countless benefits and resources to members. Explore the benefits of opening an account with a credit union in northeast Wisconsin instead of a bank. ...

What Can I Do With a Home Equity Loan in Northeast Wisconsin?

With a home equity loan in Wisconsin, you can finance a loan with lower interest rates and use that money however you need. Explore how this works. ...

How Do You Find a Great Auto Loan in Northeast Wisconsin?

When shopping for a new car, start by researching financing. Explore different lenders and auto loan rates in Wisconsin so you can find the best rate. Learn more. ...

Your Deposits Remain Safe and Insured

Recent events within the financial industry can make us think about our financial institution's stability. Capital Credit Union is financially sound! ...

All Work and No Play

Managing your own business has its perks. You’re the boss. The master of your own domain. The buck stops with you. It’s exhilarating... But also exhausting. So, like placing your own air mask before assisting others, it’s important to take care of YOU and find a healthy work/life balance. ...

The More You Know: Mortgages

When you hear the word “mortgage,” what sort of reaction do you have? For most people, it's panic or distraught. Me though? I love ‘em! That, however, is because I get to work with them every day. Well, I should say, I get to work with the people who work...

Who's Really in Charge?

Somewhere, we lost sight of who is doing whom a favor. Financial institutions make money on interest… it’s their bread and butter. If you have average to good credit, you are doing them the favor, not the other way around. You have the right to ask questions and try to...

Paint it Pink

The truth is, you can go almost anywhere and find a checking account that will work for you. Some are fancier than others, and some have less fees than others, but overall… the financial institutions pretty much leveled the playing field in the checking account game. ...