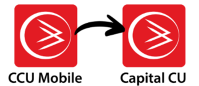

The Capital CU new app, (identified as shown here), is now available in the App Store and Google Play. You are welcome to download it, do your First Time Log In and explore the new Digital Banking environment.

The Capital CU new app, (identified as shown here), is now available in the App Store and Google Play. You are welcome to download it, do your First Time Log In and explore the new Digital Banking environment.

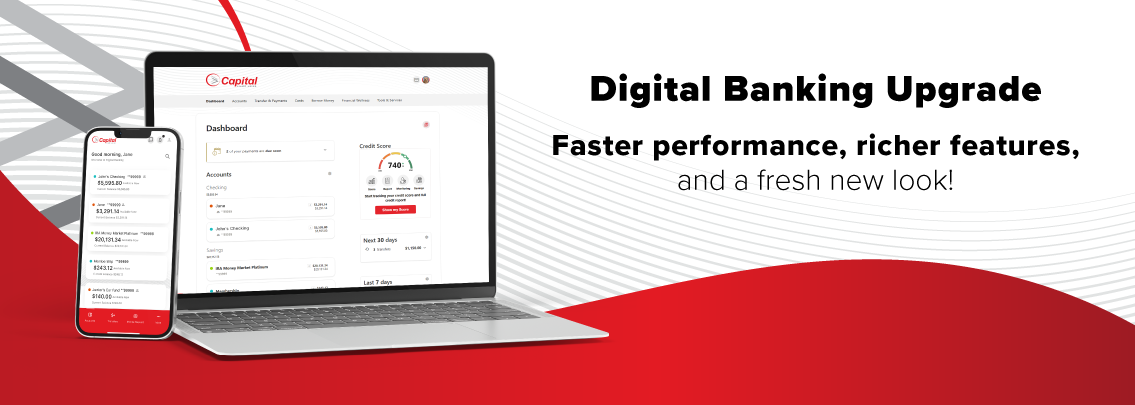

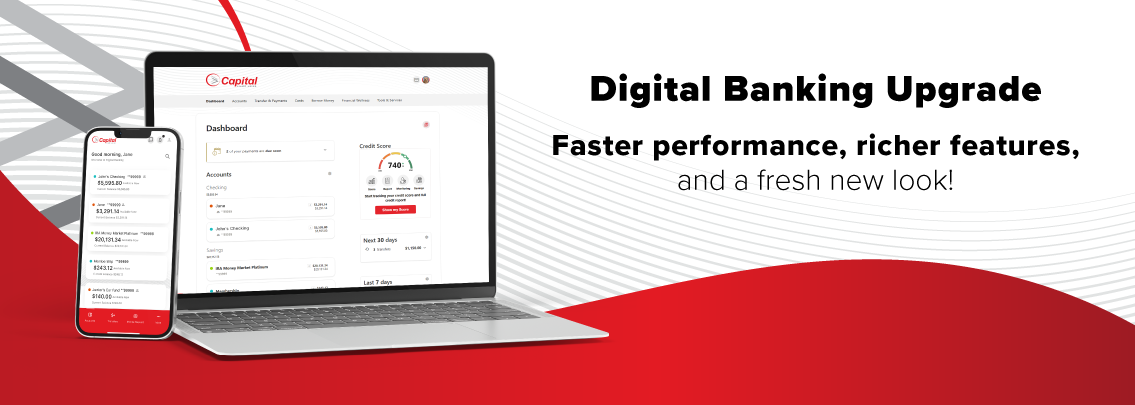

The new desktop access is now available. Find it from the Log In button on our Home Page, or bookmark the link below:

For iOS Apple users, if you're already using the Captial CU app, and have auto-update turned on, it will automatically update as the App Store releases it on Monday.

Android users will need to delete the old app and download the new app.

When the new app is released, the link will be available on this Upgrade page and also found by going directly to the App Store or Google Play Store.

The new app will say Capital CU under the logo.

Yes. Bill Pay will work and remain the same; all data/payees and scheduled payments will continue.

These alerts WILL NOT carry over. Your first Log In is the perfect time to get your alerts set up. Plus, now, you’ll have an option for push alerts. Push alerts work with your mobile device and send your account alerts to your Notification or Locked Screen view. Setting up these alerts is an excellent way to monitor and protect against fraud.

MyCards (aka CardHub) alerts will remain as you have them set up.

If you’ve linked to budgeting, accounting or other ‘outside accounts’ from your Capital CU Digital Banking, you’ll need to relink your Capital CU accounts in the new Digital Banking.

How to prepare: Quicken/QuickBooks/Credit Karma, etc.

Before August 7, 2025, we encourage you to back up and do a final download to record your past transactions. Note: we are working with each of these services, but there may be a delay of up to 30 days for them to recognize our new Digital Banking information. During that time, we recommend that you download a manual file until the reconnection to these systems is complete.

Yes, any nicknames you’ve created for your Capital CU accounts, sub accounts or loans will show up right away. You will also be able to color code your accounts, reorder them, and show/hide based on your preferences.

To complement access to our team members at our dozens of Branches, and through our Contact Center and Digital Services, providing you with powerful Digital Banking tools for on-the-go access is part of our vision, "To inspire financial well-being for all through access, care and collaboration." We can’t wait to collaborate with you in August!

Stay tuned as we continue to provide updates and information.