Digital Banking Upgrade

Treasury Management Members

We understand - change can be disruptive. However, the cleaner interface, deeper reporting and robust security tools are all part of our ongoing commitment to you and your business.

Please check your email for details specific to your accounts. We’ll also continuously update this page to provide more information. Here’s some general questions and answers:

What will my first time Log In experience be?

- Enter Username and Password

- Reset Password Prompt

- You will be prompted to create a new password

- You will select “business” user

- Verify Identity

- Identity verification is required to proceed

- Enter information only you would know

- Multi-Factor Authentication (MFA)

- You will authenticate using MFA, with options including SMS, email, or phone call for registration

- Authenticator apps offer enhanced security and can be set up during login

- Set Password

Treasury Management FAQs

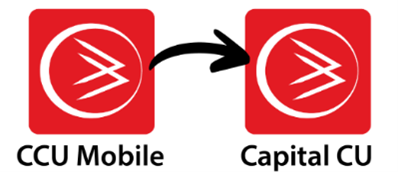

Will I need to download a new app?

For iOS Apple users, if you're already using the Captial CU app, and have auto-update turned on, it will automatically update as the App Store releases it on Monday.

Android users will need to delete the old app and download the new app.

When the new app is released, the link will be available on this Upgrade page and also found by going directly to the App Store or Google Play Store.

The new app will say Capital CU under the logo.

Should I review my contact information?

To update your info, select Tools & Services from the main navigation > Select Settings and the Contact tab.

What are the new security measures I need to know for Business ACH & Wire origination?

These changes are part of our ongoing commitment to strengthen security and protect your financial transactions.

Will my RDC scanner be affected by this update?

Yes. New scanner drivers will need to be downloaded. Our Treasury Management team will be happy to assist you. If you need assistance, please email us at TreasuryManagement@CapitalCU.com and note “Scanner Driver” as your Subject line.

Will Positive Pay change?

To access Positive Pay, you’ll find it under Business Services in the top navigation and by selecting Fraud Portal.

We truly appreciate your partnership and thank you for your continued trust as we work to bring you the best in digital banking. If you have any questions, feel free to contact us. We’ll be with you every step of the way.

DENEE MOTT, CTP

Denee Mott is Vice President of Treasury Management in our Business Services division and heads up our Public Funds efforts at Capital Credit Union. She is focused on serving the needs of our business, not-for-profit, government businesses and organizations throughout our Capital Credit Union footprint. Denee brings over 30 years of Banking and Treasury Management experience to Capital Credit Union, including 28 of those years working closely with government organizations regarding their treasury, cash, and lending needs. She works with members to avoid financial risks, improve cash flow and liquidity, expand the international marketplace, and deliver strategic banking solutions with quantifiable efficiency results. Denee holds a bachelor’s degree in finance, with an emphasis in financial planning, from the University of Wisconsin–Whitewater. She also earned the Certified Treasury Professional (CTP) designation from the Association of Financial Professionals.