Do more on the go

Experience Digital Banking

Whether you like to use a desktop computer or are always on the go, we've got you covered by making your money management simple, seamless and secure.

Your First Time Log In Experience

- Enter Username and Password

- Reset Password Prompt

- You’ll be prompted to create a new password.

- Select “for myself” or “as a business” member.

- Verify Identity

- Identity verification is required to proceed.

- Enter basic personal (or business) information only you know.

- Multi-Factor Authentication (MFA)

- Authenticate using MFA, with options including SMS or a phone call.

- Authenticator apps offer enhanced security and can be set up after your first login for future use.

- Set New Password

- Set your new, secure Digital Banking password.

- Review Disclosures

- With your successful Log In you will be presented with Disclosures and new ways to secure your accounts, such as Digital ID (which can be set up later too).

- Enjoy & Explore!

- Navigate around all the new Digital Banking experience to discover the new features, tools and alerts – all designed to help you manage your finances.

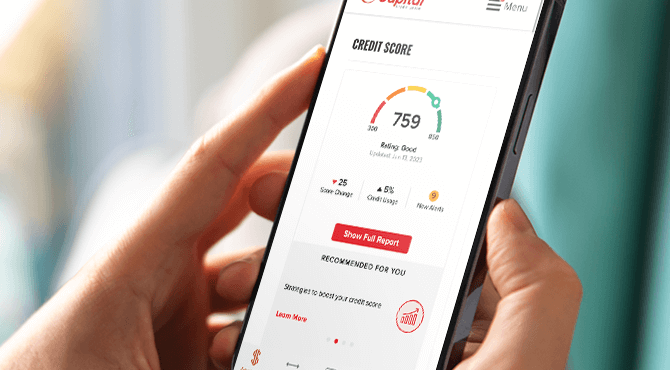

Key Features

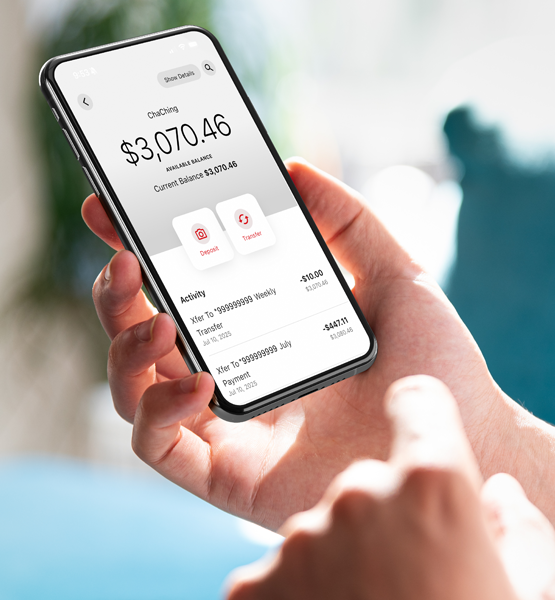

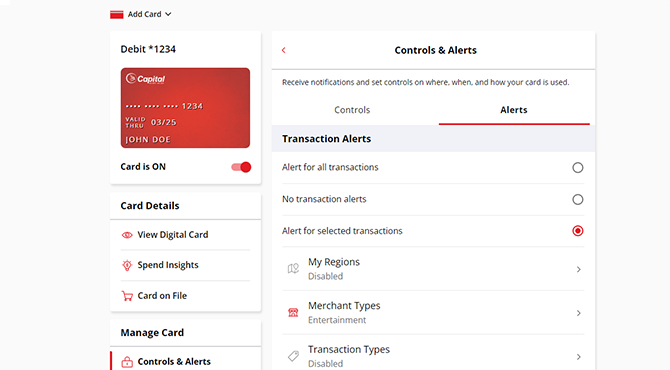

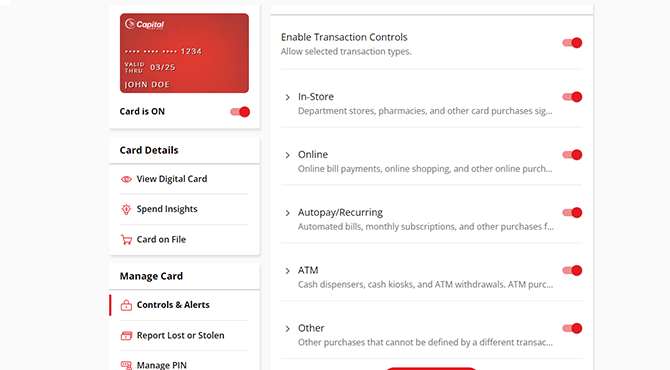

Manage Cards On the Go

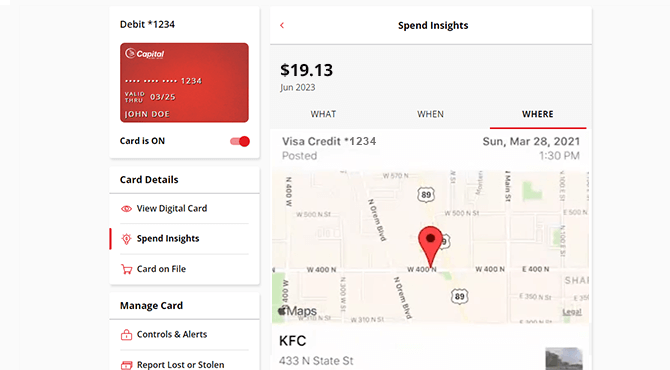

Stay aware and be in control of your cards through real-time alerts and purchase control preferences. Self-service options, including card controls and alerts, let you decide when, where and how your cards are used.Real-Time Enriched Transactions

View complete purchase information, for both pending and processed transactions, with enriched transaction data like merchant name, location, contact details and more.Understand Spending Clearly

It's easy to track where your card is being used - review spending by category, view merchants set up with reoccurring payments and access detailed visual spend history.Digital Wallet

Add your cards to your digital wallets right from MyCards and have access to your card detail whenever Apple Pay® and Google Pay® are not available.More Information About Mobile App Features

Remote Deposit

Grab your phone, take a picture, and deposit a check using our mobile app.

- Deposit checks into your account with your Android™ or Apple™ phone or tablet.

- Transactions are encrypted and secure with password protection.

- To enroll - log into app choose Deposits in either the right menu or the bottom menu.

Mobile check deposits confirmed as received before 4 PM Central Time on a business day will be credited to your account on the same business day. Deposits confirmed received after 4 PM and deposits confirmed received on holidays or days that are not our business days will be credited to your account on the next business day after the deposit is made. A longer delay in crediting your account may take place if Capital CU deems the delay is warranted (collectability or legitimacy questions, etc.) You will be notified should longer delays apply.

How to Make A Mobile Check Deposit

- If you haven't already, download Capital Credit Union's mobile app to your phone or mobile device and enroll in Digital Banking.

- In the main menu, click Deposits, or select Deposits in the bottom banner of the app.

- If this is your first time using Mobile Check Deposit, read and accept the agreement.

- On the back of your check, in the designated endorsement area, write the following: For Mobile Deposit Only at Capital CU

- Sign it

- Select the account you would like the check deposited in and enter the check amount.

- Capture Image of check (front and back) and hit Deposit.

Security Features

- Get advanced security features, like multi-factor authentication on each login. Options include SMS, phone calls, email, and authenticator apps (e.g., Google Authenticator)

- Authenticator App Support generates time-sensitive one-time passwords (OTPs) for two-factor authentication, adding an extra layer of security

- Use biometric login (face and fingerprint ID) on supported devices for quick and secure access

- Receive security alerts that notify you of important events, such as successful logins or changes to your contact information

.png)

.png)

.png)

.png)

.png)

.png)