When people talk about the reasons they can’t build wealth, the usual suspects always come up:

- Cars – They depreciate the moment you drive them off the lot.

- Inflation – Today’s million dollars won’t stretch far in 40 years.

- Divorce – Emotionally and financially devastating.

- Fear – “Why would I invest? The market is just going to crash.”

- Credit cards and debt – A fast road to financial instability.

While each of these can absolutely hinder your financial future, they all share one common root cause:

A lack of financial education.

Why Financial Illiteracy is the True Wealth Killer

When people don’t understand how money works, it manifests in damaging ways—fear, procrastination, comparison, and overspending. It’s not knowing what to do, and doing nothing as a result.

- 90% of Americans say they want to build wealth.

- But 50% admit they don’t know where to start.[1]

And that’s not a motivational quote—it’s a systemic issue. But the good news? It’s fixable.

Fact #1: Financial Success Isn’t a Zero-Sum Game

We often hear phrases like “the system is rigged” or “someone else has to lose in order for me to win.” That’s simply not true in personal finance or investing.

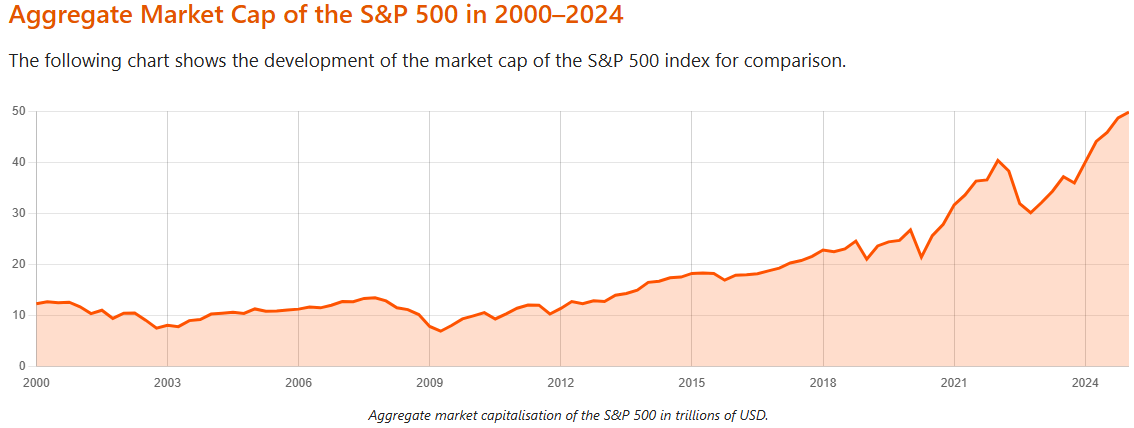

The stock market isn’t a casino. It’s an ever-expanding pie.

The market cap of the S&P 500 at the end of 1999 was $12.31 Trillion—at the end of 2024, the market cap was $49.81 Trillion!

Financial independence is not exclusive. It’s achievable for anyone with the knowledge, patience, and discipline to pursue it.

Fact #2: Small Decisions Today = Big Impact Tomorrow

Your daily money choices may feel minor, but they build up over time—for better or worse.

Let’s look at one real-life example:

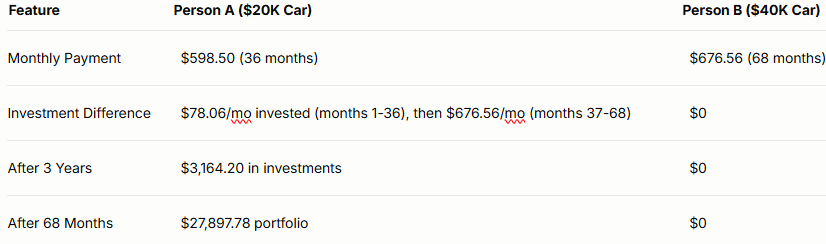

Choosing a $20K car vs a $40K car *

*Assumes 8% annual return and a 5% interest rate

At the end of 68 months, both have a paid-in-full vehicle but Person A also has an investment portfolio that is larger than the purchase price of their vehicle. Now imagine if that $27,897.78 stays invested until retirement:

With 30 years of growth at 8% annually, that turns into $305,000+.

So, what’s more important—looking wealthy or being wealthy?

Fact #3: You Don’t Need to Get Every Decision Right

You don’t have to be perfect. Even Warren Buffett says:

“You only have to do a very few things right in your life so long as you don’t do too many things wrong.”

Focus on the timeless principles:

- Spend less than you earn. Live within your means.

- Invest early and consistently.

- Stay in the market, don’t try to time it. Time in the market will always beat timing the market.

- Understand opportunity cost (what you give up for every financial decision).

Fact #4: It Won’t Always Feel Good

We’re wired to chase what feels good now. That new car, the vacation, the designer wardrobe. But short-term pleasure often sacrifices long-term gain.

And when it comes to parenting?

We want our kids to have what we didn’t—but we can’t give what we don’t have.

Saving for their college is noble—but you need to secure your own retirement first. Just like in an airplane emergency: put your own oxygen mask on before helping others.

The best gift we can give our kids? A model of strong financial behavior.

Fact #5: There’s Still Time

If you’ve made it this far, you’ve already taken the first step.

A lot of people think they’re “too late” to get their finances on track, but the truth is that in the time you have left you can still make a meaningful impact, especially if you’re intentional with your choices. As the saying goes: “The best time to plant a tree was 20 years ago. The second best time is today.”

The power of financial transformation isn’t just in compounding returns—it’s in compounding behaviors. Small, consistent actions today can create serious momentum.

Empower yourself with the guidance and tools you need to take that next step toward achieving your financial dreams.

- Connect with an advisor from Capital Investment Group

- Sign up for complimentary financial education classes

- Access Capital Credit Union’s online financial education resources

- Stay informed with the Capital Credit Union Blog