Cha-Ching™

ChaChing™ Checking

Make your money work as hard as you do.

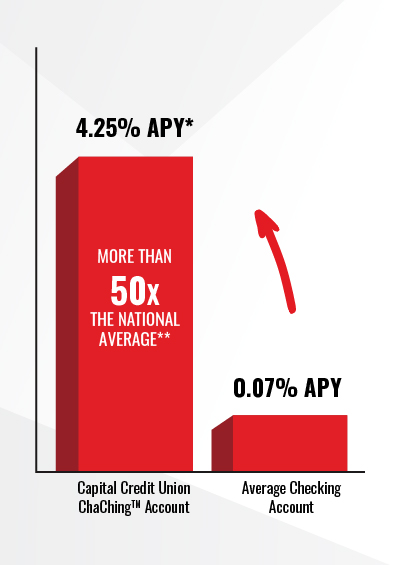

With ChaChing™ Checking, you’ll earn an impressive 4.25% APY – that’s 50 times the national average**! It’s more than just a checking account; it’s a way to make your money work hard for you while you enjoy everything Wisconsin winters have to offer.

Our Members Earn More

With ChaChing™ Checking, you’re not just getting a place to keep your cash—you’re unlocking a smarter way to save, spend, and thrive. This isn’t just a checking account. It’s your partner in progress, designed to help you build a brighter financial future without missing a beat.Open ChaChing™ Checking

It's about your money. Making money!

We don't offer just average checking accounts. We offer checking accounts that offer smart rewards that pay you back and help grow your money. Let's find out together and discover if ChaChing™ Checking is right for you.- You're looking to earn money on the funds in your checking account.

- A frequent user of your debit card.

- You are looking to get reimbursements on ATM fees.

- Willing to enroll in direct deposit and receive eStatements to maximize your earnings?

- You are looking for an account that offers unlimited deposits and withdrawals.

You work hard. We make it easy for your money to work hard too!

| AVERAGE DAILY BALANCE | INTEREST EARNED AFTER ONE MONTH | INTEREST EARNED AFTER ONE YEAR |

|---|---|---|

| $15,000 | $53.13 | $637.50 |

| $10,000 | $35.42 | $425 |

| $5,000 | $17.71 | $212.50 |

| $2,500 | $8.85 | $106.25 |

| $1,000 | $3.54 | $42.50 |

| $500 | $1.77 | $21.25 |

We Invest In YOU!

Capital Credit Union isn’t just about finances—we’re about people, community, and building a better future together. Our members are at the heart of everything we do. That’s why we invest in tools and accounts like ChaChing™ Checking—to help you reach your goals while feeling supported every step of the way.

Capital Off the Cuff

Traditional vs. High-Yield Checking Account: Which Is Right for You?

Compare the features, pros, and cons of traditional vs. high-yield checking accounts to determine which suits your financial needs and goals best. ...

Are There High-Interest Checking Accounts?

Making money from your checking account is an idea that most people can get behind. We could all use a little extra money in the bank, and while standard checking accounts can sometimes offer you a small percentage of interest back on your balance, there may be other options available...

How To Open a Checking Account Online

Discover the simple steps for opening a checking account online, and explore expert tips so you can find the best checking account for you. Get started today! ...

How To Open a Checking Account Online

Discover the simple steps for opening a checking account online, and explore expert tips so you can find the best checking account for you. Get started today! ...

How To Open a Checking Account Online

Discover the simple steps for opening a checking account online, and explore expert tips so you can find the best checking account for you. Get started today! ...

5 Ways to Improve Your Financial Literacy

Boost your financial skills with free financial literacy classes, smart budgeting, credit tips, and more. Take control of your money and build a secure future. ...

5 Ways to Improve Your Financial Literacy

Boost your financial skills with free financial literacy classes, smart budgeting, credit tips, and more. Take control of your money and build a secure future. ...

5 Ways to Improve Your Financial Literacy

Boost your financial skills with free financial literacy classes, smart budgeting, credit tips, and more. Take control of your money and build a secure future. ...

**Comparison based on Capital Credit Union 4.25% APY as of Rates effective 2/1/2025 versus .07 the national average checking accounts that earn interest sourced from FDIC National Rates and Rate Cap as of 09/15/2025.

†0.50% loan discount on vehicle and personal loans requires an active checking account with at least $400 in deposits each month and 12 transactions of $5 or more during the month. $2,500 minimum new loan money or additional $2,500 to any existing Capital Credit Union loan required.

‡Qualifying purchase transactions must post and clear the account during the monthly cycle. Transactions may take one or more business days from the transaction date to post to an account from the date the transaction is made. Debit card purchase transactions can be made by signature or Point-of-Sale (using a PIN to make a purchase at a merchant).

Transfers between Capital accounts do not count as qualifying ACH transactions. Minimum to open account is $1. ATM fee reimbursements up to $10 provided only if qualifications are met within the monthly cycle.

Maximum of 2 ChaChing™ accounts per membership share.